Laps of Luxury: The Priciest Neighborhoods To Buy a Home—State by State

Laps of Luxury: The Priciest Neighborhoods To Buy a Home—State by State

By Evan Wyloge

Nov 14, 2023

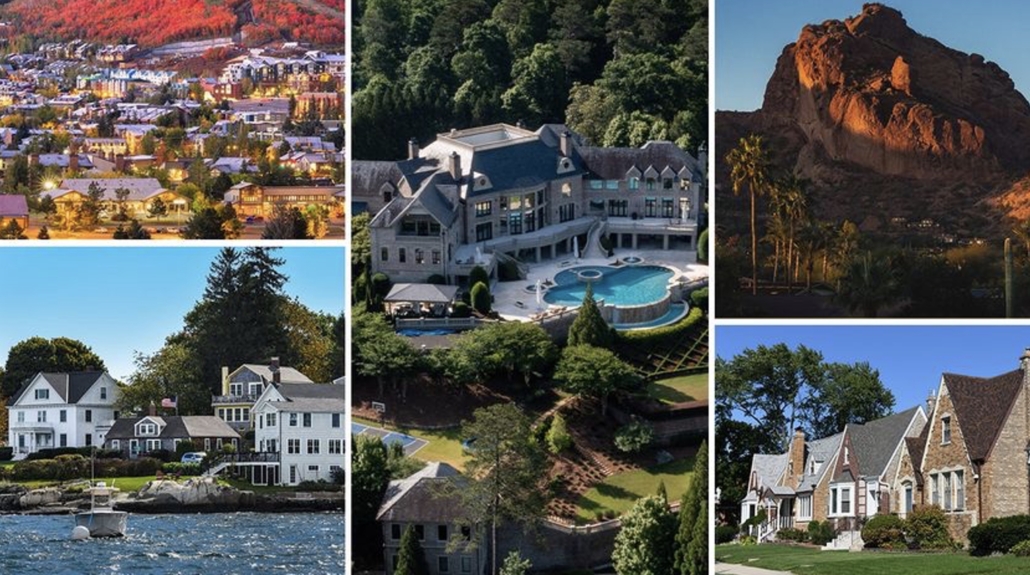

There’s a quiet but undeniable thrill that comes from browsing photos and taking virtual tours of the most opulent properties in America. It’s a hobby less about browsing for a home and more about the fantasy—unless you’re in the richest 1% and could easily afford one of these lavish abodes.

But rest assured, there’s nothing wrong with poring over photos of luxury homes that you’ll buy when you win the Powerball/sell that screenplay you’ve been working on since high school/launch the next great tech startup. We get it! The data team at Realtor.com® found all of the poshest neighborhoods in the nation for your perusing pleasure.

We found the priciest ZIP code in every state with the highest median home list price in October, excluding areas with fewer than 25 listings. Many are upscale vacation destinations popular with the uber-wealthy.

It’s a coast-to-coast tour of extravagance, from breezy Hawaiian beaches and the dramatic shorelines of Maine to the rugged terrain of Colorado’s San Juan Mountains and Arizona’s sun-baked Sonoran Desert.

So, whether you’re in the market for a mansion or only musing, take a tour of some of the most extraordinary real estate in America.

Alabama

Most expensive ZIP code: Arley (35541)

Median list price: $1,050,000Median square footage: 2,888

Most expensive listing: $2,290,000, 5,095-square-foot, 5-bedroom home

Alaska

Most expensive ZIP code: Anchorage (99516)

Median list price: $770,000

Median square footage: 3,007

Most expensive listing: $2,800,000, 3,503-square-foot, 7-bedroom home

Arizona

Most expensive ZIP code: Paradise Valley (85253)

Median list price: $4,856,250

Median square footage: 5,561

Most expensive listing: $75,000,000, 40,000-square-foot, 13-bedroom home

Arkansas

Most expensive ZIP code: Bentonville (72712)

Median list price: $725,000

Median square footage: 2,318

Most expensive listing: $8,000,000, 8,128-square-foot, 5-bedroom home

California

Most expensive ZIP code: Los Angeles (90077)

Median list price: $8,625,000

Median square footage: 5,565

Most expensive listing: $139,000,000, 12-bedroom home

Colorado

Most expensive ZIP code: Mountain Village (81435)

Median list price: $5,525,000

Median square footage: 2,861

Most expensive listing: $34,500,000, 30,018-square-foot, 14-bedroom home

Connecticut

Most expensive ZIP code: Greenwich (06831)

Median list price: $4,511,250

Median square footage: 6,063

Most expensive listing: $39,500,000, 14,296-square-foot, 6-bedroom home

Delaware

Most expensive ZIP code: Bethany Beach (19930)

Median list price: $1,103,500

Median square footage: 1,850

Most expensive listing: $2,990,000, 3,386-square-foot, 5-bedroom home

Florida

Most expensive ZIP code: Coral Gables (33156)

Median list price: $4,175,000

Median square footage: 4,476

Most expensive listing: $69,900,000, 12,159-square-foot, 7-bedroom home

Georgia

Most expensive ZIP code: Atlanta (30327)

Median list price: $2,371,250

Median square footage: 5,567

Most expensive listing: $46,800,000, 17,776-square-foot, 7-bedroom home

Hawaii

Most expensive ZIP code: Kilauea (96754)

Median list price: $4,112,500

Median square footage: 2,429

Most expensive listing: $15,000,000, 7,400-square-foot, 5-bedroom home

Idaho

Most expensive ZIP code: Ketchum (83340)

Median list price: $4,185,000

Median square footage: 3,191

Most expensive listing: $21,250,000, 10,184-square-foot, 6-bedroom home

Illinois

Most expensive ZIP code: Winnetka (60093)

Median list price: $1,650,000

Median square footage: 4,495

Most expensive listing: $8,900,000, 9,673-square-foot, 9-bedroom home

Indiana

Most expensive ZIP code: Zionsville (46077)

Median list price: $724,900

Median square footage: 3,752

Most expensive listing: $4,999,999, 5,508-square-foot, 4-bedroom home

Iowa

Most expensive ZIP code: Clive (50325)

Median list price: $575,482

Median square footage: 1,986

Most expensive listing: $3,750,000, 5,971-square-foot, 6-bedroom home

Kansas

Most expensive ZIP code: Mission Hills (66208)

Median list price: $1,028,750

Median square footage: 3,006

Most expensive listing: $4,950,000, 4,843-square-foot, 5-bedroom home

Kentucky

Most expensive ZIP code: Prospect (40059)

Median list price: $784,700

Median square footage: 3,771

Most expensive listing: $3,550,000, 13,681-square-foot, 5-bedroom home

Louisiana

Most expensive ZIP code: New Orleans (70124)

Median list price: $618,000

Median square footage: 2,612

Most expensive listing: $3,595,000, 6,820-square-foot, 6-bedroom home

Maine

Most expensive ZIP code: Falmouth (04105)

Median list price: $1,149,500

Median square footage: 2,909

Most expensive listing: $7,500,000, 10,849-square-foot, 13-bedroom home

Maryland

Most expensive ZIP code: Bethesda (20817)

Median list price: $2,222,500

Median square footage: 5,068

Most expensive listing: $11,500,000, 15,000-square-foot, 6-bedroom home

Massachusetts

Most expensive ZIP code: Boston (02108)

Median list price: $5,687,500

Median square footage: 3,468

Most expensive listing: $31,000,000, 10,858-square-foot, 5-bedroom home

Michigan

Most expensive ZIP code: Bloomfield Hills (48301)

Median list price: $1,084,750

Median square footage: 3,730

Most expensive listing: $2,950,000, 6,300-square-foot, 4-bedroom home

Minnesota

Most expensive ZIP code: Wayzata (55391)

Median list price: $1,716,000

Median square footage: 3,963

Most expensive listing: $14,750,000, 9,016-square-foot, 5-bedroom home

Mississippi

Most expensive ZIP code: Madison (39110)

Median list price: $525,000

Median square footage: 2,663

Most expensive listing: $2,499,000, 6,260-square-foot, 5-bedroom home

Missouri

Most expensive ZIP code: Saint Louis (63131)

Median list price: $1,498,750

Median square footage: 4,694

Most expensive listing: $4,975,000, 3,046-square-foot, 3-bedroom home

Montana

Most expensive ZIP code: Whitefish (59937)

Median list price: $1,487,000

Median square footage: 2,109

Most expensive listing: $31,500,000, 4,868-square-foot, 3-bedroom home

Nebraska

Most expensive ZIP code: Valley (68064)

Median list price: $910,000

Median square footage: 3,378

Most expensive listing: $2,150,000, 5,578-square-foot, 5-bedroom home

Nevada

Most expensive ZIP code: Incline Village (89451)

Median list price: $2,988,500

Median square footage: 2,695

Most expensive listing: $76,000,000, 14,197-square-foot, 7-bedroom home

New Hampshire

Most expensive ZIP code: Portsmouth (03801)

Median list price: $1,066,725

Median square footage: 1,945

Most expensive listing: $4,900,000, 5,055-square-foot, 5-bedroom condo/townhome/rowhome/co-op

New Jersey

Most expensive ZIP code: Stone Harbor (08247)

Median list price: $4,387,250

Median square footage: 2,797

Most expensive listing: $9,999,000, 3,000-square-foot, 5-bedroom home

New Mexico

Most expensive ZIP code: Santa Fe (87506)

Median list price: $2,156,250

Median square footage: 3,616

Most expensive listing: $14,250,000, 7,764-square-foot, 5-bedroom home

New York

Most expensive ZIP code: Water Mill (11976)

Median list price: $7,995,000

Median square footage: 7,171

Most expensive listing: $59,950,000, 17,173-square-foot, 13-bedroom home

North Carolina

Most expensive ZIP code: Cashiers (28717)

Median list price: $1,958,750

Median square footage: 10,037

Most expensive listing: $9,000,000, 10,037-square-foot, 11-bedroom home

North Dakota

Most expensive ZIP code: Fargo (58104)

Median list price: $439,900

Median square footage: 2,657

Most expensive listing: $2,395,000, 9,778-square-foot, 6-bedroom home

Ohio

Most expensive ZIP code: Moreland Hills (44022)

Median list price: $1,012,450

Median square footage: 4,639

Most expensive listing: $5,900,000, 16,502-square-foot, 5-bedroom home

Oklahoma

Most expensive ZIP code: Tulsa (74137)

Median list price: $677,225

Median square footage: 3,972

Most expensive listing: $4,200,000, 7,703-square-foot, 4-bedroom home

Oregon

Most expensive ZIP code: Bend (97703)

Median list price: $1,237,250

Median square footage: 2,349

Most expensive listing: $4,300,000, 6,330-square-foot, 4-bedroom home

Pennsylvania

Most expensive ZIP code: New Hope (18938)

Median list price: $1,848,750

Median square footage: 3,976

Most expensive listing: $14,500,000, 17,899-square-foot, 7-bedroom home

Rhode Island

Most expensive ZIP code:Jamestown (02835)

Median list price: $1,787,500

Median square footage: 2,688

Most expensive listing: $4,500,000, 5,888-square-foot, 4-bedroom home

South Carolina

Most expensive ZIP code: Sunset (29685)

Median list price: $2,041,093

Median square footage: 4,920

Most expensive listing: $5,939,000, 5-bedroom home

South Dakota

Most expensive ZIP code: Lead (57754)

Median list price: $922,000

Median square footage: 2,724

Most expensive listing: $1,999,900, 5,357-square-foot, 7-bedroom home

Tennessee

Most expensive ZIP code: College Grove (37046)

Median list price: $2,698,476

Median square footage: 5,242

Most expensive listing: $14,000,000, 10,802-square-foot, 5-bedroom home

Texas

Most expensive ZIP code: Dallas (75205)

Median list price: $3,770,000

Median square footage: 4,809

Most expensive listing: $19,500,000, 14,181-square-foot, 6-bedroom home

Utah

Most expensive ZIP code: Park City (84098)

Median list price: $1,881,000

Median square footage: 3,032

Most expensive listing: $32,000,000, 18,409-square-foot, 6-bedroom home

Vermont

Most expensive ZIP code: Stowe (05672)

Median list price: $1,556,000

Median square footage: 3,000

Most expensive listing: $20,000,000, 15,774-square-foot, 6-bedroom home

Virginia

Most expensive ZIP code: Mclean (22101)

Median list price: $3,305,000

Median square footage: 7,240

Most expensive listing: $50,000,000, 30,000-square-foot, 6-bedroom home

Washington

Most expensive ZIP code: Mercer Island (98040)

Median list price: $2,745,000

Median square footage: 3,535

Most expensive listing: $37,900,000, 10,300-square-foot, 5-bedroom home

Washington, DC

Most expensive ZIP code:Washington, DC (20015)

Median list price: $1,446,225

Median square footage: 2,379

Most expensive listing: $4,985,000, 6,638-square-foot, 6-bedroom home

West Virginia

Most expensive ZIP code: Shepherdstown (25443)

Median list price: $612,500

Median square footage: 2,408

Most expensive listing: $5,200,000, 10,285-square-foot, 11-bedroom home

Wisconsin

Most expensive ZIP code: Green Bay (54304)

Median list price: $729,900

Median square footage: 1,883

Most expensive listing: $1,901,900, 3,169-square-foot, 4-bedroom condo/townhome/rowhome/co-op

Wyoming

Most expensive ZIP code: Wilson (83014)

Median list price: $6,960,000

Median square footage: 3,341

Most expensive listing: $24,900,000, 7,432-square-foot, 5-bedroom home